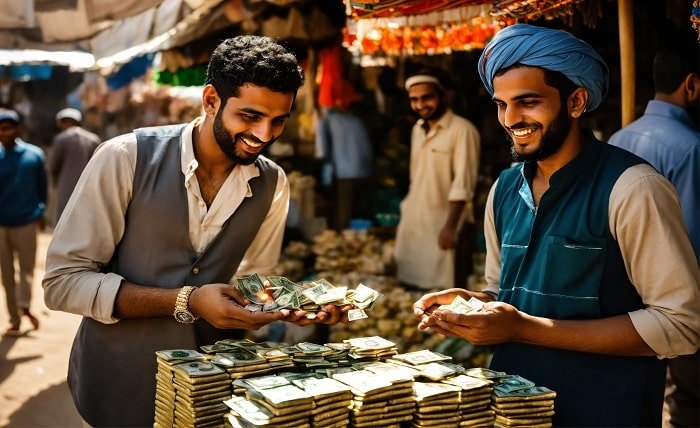

In the realm of international finance, wholesale money changers stand as the backbone of currency exchange operations. From facilitating large-scale transactions to ensuring liquidity in global markets, these entities play a pivotal role in shaping the dynamics of international trade. In this comprehensive guide, we delve into the intricacies of wholesale money changers, exploring their functions, significance, and impact on the global economy.

Wholesale Money Changers:

Wholesale money changers are specialized financial institutions or entities that engage in large-scale currency exchange transactions. These entities primarily cater to institutional clients such as banks, corporations, and government agencies, facilitating transactions involving substantial volumes of currency.

The Role of Wholesale Money Changers in International Trade:

Wholesale money changers serve as vital intermediaries in international trade, enabling seamless currency conversion for businesses engaged in cross-border transactions. By providing competitive exchange rates and efficient execution, they facilitate smoother trade operations and mitigate currency-related risks.

Operating Mechanisms of Wholesale Money Changers:

Wholesale money changers operate through sophisticated trading platforms and networks that connect them to various financial markets globally. Leveraging advanced technologies and market insights, they execute transactions swiftly and accurately, ensuring optimal outcomes for their clients.

Importance of Wholesale Money Changers in Risk Management:

In the volatile landscape of international finance, managing currency risk is paramount for businesses operating across borders. Wholesale money changers offer hedging solutions and forward contracts, enabling clients to mitigate exposure to exchange rate fluctuations and safeguard their financial interests.

Regulatory Framework Governing Wholesale Money Changers:

Wholesale money changers operate within a regulatory framework established by financial authorities in their respective jurisdictions. Compliance with regulatory standards ensures transparency, integrity, and stability within the wholesale currency exchange market, fostering trust among market participants.

Technological Advancements Transforming Wholesale Money Changing:

The advent of technology has revolutionized the operations of wholesale money changers, enabling automation, algorithmic trading, and real-time market monitoring. These technological advancements enhance efficiency, reduce costs, and enable better risk management strategies.

Global Impact of Wholesale Money Changers on Economic Stability:

Wholesale money changers contribute to the stability of the global economy by facilitating smooth currency exchange transactions and fostering liquidity in financial markets. Their efficient operations help maintain equilibrium in exchange rates and support sustainable economic growth.

Evolution of Wholesale Money Changers in the Digital Era:

With the rise of digitalization, wholesale money changers are embracing fintech innovations to enhance their service offerings and reach a broader client base. Online trading platforms, mobile applications, and blockchain technology are revolutionizing the landscape of wholesale currency exchange.

Challenges and Opportunities in the Wholesale Money Changing Industry:

Despite their pivotal role, wholesale money changers face challenges such as regulatory compliance, cybersecurity risks, and market volatility. However, these challenges also present opportunities for innovation, collaboration, and diversification within the industry.

Future Outlook for Wholesale Money Changers:

Looking ahead, wholesale money changers are poised to play an increasingly influential role in the global financial ecosystem. As international trade continues to expand, the demand for efficient currency exchange services will grow, presenting ample opportunities for growth and innovation in the wholesale money changing industry.

Conclusion:

Wholesale money changers are indispensable players in the global financial landscape, facilitating seamless currency exchange transactions and fostering economic stability. As key intermediaries in international trade, they play a crucial role in driving commerce forward and shaping the dynamics of the global economy.

FAQ:

1.What distinguishes wholesale money changers from retail currency exchange providers?

Wholesale money changers primarily cater to institutional clients and engage in large-scale currency transactions, whereas retail currency exchange providers serve individual consumers and smaller businesses.

2.How do wholesale money changers mitigate currency-related risks for their clients?

Wholesale money changers offer hedging solutions, forward contracts, and risk management strategies to help clients mitigate exposure to exchange rate fluctuations and safeguard their financial interests.

3.Are wholesale money changers subject to regulatory oversight?

Yes, wholesale money changers operate within a regulatory framework established by financial authorities in their respective jurisdictions to ensure transparency, integrity, and stability within the wholesale currency exchange market.

4.How do technological advancements impact the operations of wholesale money changers?

Technological advancements such as automation, algorithmic trading, and real-time market monitoring enhance the efficiency, reduce costs, and enable better risk management strategies for wholesale money changers.

5.What are the future prospects for the wholesale money changing industry?

The wholesale money changing industry is poised for growth and innovation as international trade expands, presenting opportunities for wholesale money changers to enhance their service offerings and expand their global reach.