Forex Trading Book

Introduction

Forex trading books are invaluable resources for both novice and experienced traders looking to enhance their knowledge and skills in the foreign exchange market. These books cover a wide range of topics, from basic concepts to advanced trading strategies, making them essential tools for anyone serious about forex trading.

Why You Need a Forex Trading Book

Investing in a forex trading book is crucial for gaining a solid understanding of the forex market. A good forex trading book can provide insights into market trends, technical analysis, and risk management, helping traders make informed decisions and improve their trading performance.

Types of Forex Trading Books

Forex trading books come in various types, each catering to different aspects of trading. Some focus on technical analysis, others on fundamental analysis, while some offer comprehensive trading strategies. Choosing the right type of forex trading book depends on your level of experience and specific learning needs.

Top Forex Trading Books for Beginners

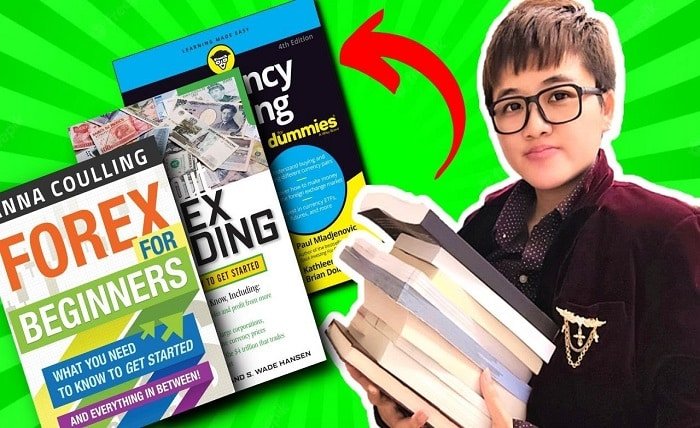

For beginners, selecting a forex trading book that covers the basics is essential. Books like “Forex for Beginners” by Anna Coulling and “Currency Trading for Dummies” by Kathleen Brooks and Brian Dolan provide a solid foundation in forex trading, explaining key concepts and strategies in an easy-to-understand manner.

Advanced Forex Trading Books

Experienced traders can benefit from advanced forex trading books that delve deeper into complex strategies and analysis techniques. Titles such as “Trading in the Zone” by Mark Douglas and “Technical Analysis of the Financial Markets” by John Murphy are highly recommended for those looking to refine their trading skills and strategies.

The Importance of Technical Analysis in Forex Trading Books

Technical analysis is a critical component of forex trading, and many forex trading books emphasize its importance. Books like “Japanese Candlestick Charting Techniques” by Steve Nison provide in-depth knowledge of chart patterns and indicators, helping traders predict market movements and make informed decisions.

Fundamental Analysis in Forex Trading Books

Understanding fundamental analysis is equally important for successful forex trading. A forex trading book focusing on fundamental analysis, such as “The Little Book of Currency Trading” by Kathy Lien, can help traders understand the economic factors that influence currency values and how to incorporate this knowledge into their trading strategies.

Risk Management Strategies in Forex Trading Books

Risk management is a crucial aspect of forex trading that cannot be overlooked. Forex trading books like “The Disciplined Trader” by Mark Douglas and “Trade Your Way to Financial Freedom” by Van Tharp provide valuable insights into risk management techniques, helping traders protect their investments and minimize losses.

Developing a Trading Plan with Forex Trading Books

A well-structured trading plan is essential for success in forex trading. Forex trading books that guide you through the process of creating and sticking to a trading plan, such as “The Forex Trading Course” by Abe Cofnas, can significantly improve your trading discipline and consistency.

Using Forex Trading Books for Strategy Development

Developing effective trading strategies is a key goal for any trader. Forex trading books like “Day Trading and Swing Trading the Currency Market” by Kathy Lien offer practical advice and strategies that traders can implement to enhance their profitability and trading efficiency.

Psychological Aspects of Trading in Forex Trading Books

The psychological aspect of trading is often overlooked but is crucial for long-term success. Forex trading books such as “Trading Psychology 2.0” by Brett Steenbarger address the mental challenges traders face and provide techniques for maintaining discipline and emotional control.

The Role of Case Studies in Forex Trading Books

Case studies in forex trading books offer real-world examples of trading scenarios, helping traders understand the practical application of theories and strategies. Books like “Market Wizards” by Jack D. Schwager provide insights from successful traders, offering valuable lessons and inspiration.

Conclusion

A forex trading book is an essential tool for anyone looking to succeed in the forex market. Whether you’re a beginner or an experienced trader, there is a wealth of knowledge available in forex trading books to help you improve your trading skills, develop effective strategies, and manage risks effectively. By investing time in reading and learning from these books, you can enhance your understanding of the forex market and increase your chances of success.

FAQs

1. What is the best forex trading book for beginners?

For beginners, “Forex for Beginners” by Anna Coulling and “Currency Trading for Dummies” by Kathleen Brooks and Brian Dolan are excellent choices as they cover the basics comprehensively.

2. How can a forex trading book help with risk management?

A forex trading book on risk management provides strategies and techniques to protect your investments and minimize losses, ensuring long-term trading success.

3. Are there forex trading books that focus on technical analysis?

Yes, books like “Japanese Candlestick Charting Techniques” by Steve Nison and “Technical Analysis of the Financial Markets” by John Murphy focus extensively on technical analysis.

4. Can a forex trading book improve my trading psychology?

Absolutely, books like “Trading Psychology 2.0” by Brett Steenbarger provide insights into managing the psychological challenges of trading, helping you maintain discipline and emotional control.

5. What advanced forex trading books should I read?

Advanced traders should consider reading “Trading in the Zone” by Mark Douglas and “Technical Analysis of the Financial Markets” by John Murphy to deepen their knowledge and refine their strategies.