Introduction

In the globalized economy, bulk currency exchange stands as a crucial operation for businesses that deal with international transactions. Understanding the nuances of bulk currency exchange can significantly affect the financial health of a business, influencing everything from cash flow management to profitability. This blog post aims to provide a deep dive into the strategies, benefits, and best practices for managing currency exchange on a large scale.

Bulk Currency Exchange

Bulk currency exchange involves converting large amounts of one currency into another, typically for business transactions, investments, or hedging against currency risk. This process is fundamental for companies that operate across multiple countries. By mastering bulk currency exchange, businesses can save significant amounts of money and avoid potential risks associated with currency fluctuations.

The Importance of Currency Exchange Rates

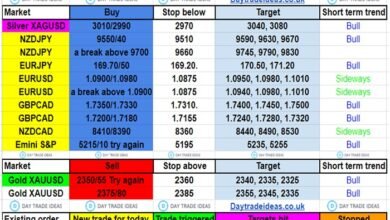

The exchange rate is a critical factor in bulk currency exchange. It determines how much one currency is worth in terms of another and can fluctuate based on market conditions, economic indicators, and geopolitical events. Businesses must monitor these rates closely to time their transactions effectively and maximize their returns or minimize costs on exchanges.

Choosing the Right Platform for Bulk Currency Exchange

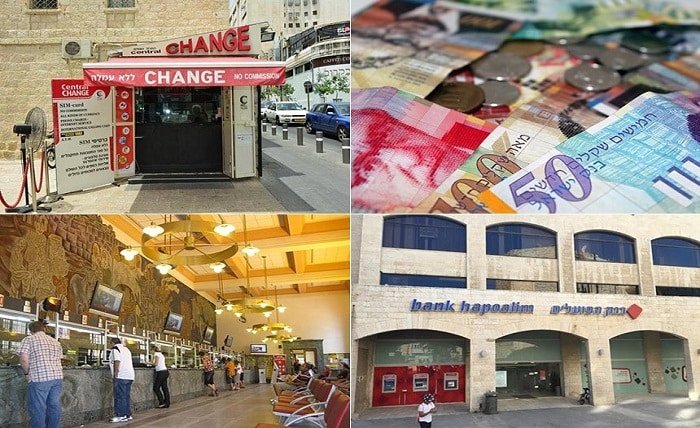

Selecting the appropriate platform for conducting bulk currency exchange is vital. Various online brokers, banks, and specialized financial institutions offer services for large-scale currency transactions. Comparing these platforms based on fees, exchange rates, transaction speeds, and security features is essential to ensure efficient and safe exchanges.

Hedging Strategies in Bulk Currency Exchange

To mitigate risks associated with fluctuating exchange rates, businesses often use hedging strategies. These can include forward contracts, options, and futures, which allow companies to lock in exchange rates at a particular value for future transactions. Implementing these tools can provide financial stability and predictability in international dealings.

Technological Advances in Bulk Currency Exchange

Technology plays a significant role in modern bulk currency exchange. Automated trading platforms, AI-driven predictive analytics, and blockchain technology are reshaping how businesses handle large currency exchanges. These technologies offer improved accuracy, speed, and security, reducing the risk of errors and fraud.

Impact of Global Economic Changes on Bulk Currency Exchange

Global economic events can significantly impact exchange rates and, consequently, bulk currency exchange strategies. Businesses need to stay informed about international economic indicators, such as inflation rates, GDP growth, and monetary policy changes, to adapt their currency exchange practices accordingly.

Best Practices for Managing Currency Risk

Effective management of currency risk is pivotal for businesses engaged in bulk currency exchange. Regularly reviewing and adjusting currency positions, diversifying currency holdings, and using stop-loss orders are practical measures to manage potential risks associated with currency fluctuations.

Case Studies: Success Stories in Bulk Currency Exchange

Analyzing successful case studies of businesses that have optimized their bulk currency exchange processes can provide valuable lessons and actionable insights. These case studies highlight the strategies that companies have implemented to manage currency risks and enhance their profitability through efficient exchange practices.

Preparing for the Future of Bulk Currency Exchange

As the global economy evolves, so too will the practices surrounding bulk currency exchange. Businesses must be proactive in anticipating changes and adapting their strategies. Staying ahead of trends, such as digital currencies and changes in international trade agreements, is crucial for maintaining a competitive edge.

Conclusion

Bulk currency exchange is a complex but essential aspect of modern business operations. By understanding the intricacies of currency markets, choosing the right trading platforms, and employing effective hedging strategies, businesses can enhance their financial operations and protect themselves against potential losses. Adopting advanced technologies and staying informed about global economic trends will further empower businesses to manage their currency needs efficiently.

FAQs

1. What is bulk currency exchange?

Bulk currency exchange refers to the process of exchanging large amounts of one currency for another, typically used by businesses involved in international transactions to manage their currency needs.

2. Why is monitoring exchange rates important for bulk currency exchange?

Monitoring exchange rates is crucial as it helps businesses time their transactions to optimize the financial outcomes of exchanges, taking advantage of favorable rates and minimizing costs.

3. What are some common hedging strategies used in bulk currency exchange?

Common hedging strategies include the use of forward contracts, options, and futures, which help businesses lock in favorable exchange rates for future transactions, thereby reducing risk.

4. How can technology impact bulk currency exchange?

Technology, such as automated trading platforms and blockchain, enhances the accuracy, speed, and security of bulk currency exchanges, making these transactions more efficient and less susceptible to errors and fraud.

5. What steps can businesses take to prepare for future changes in bulk currency exchange?

Businesses can prepare by staying informed about global economic trends, adopting new technologies, and continuously refining their currency exchange and risk management strategies to adapt to the evolving market conditions.