Introduction:

The question of whether stock brokers still exist is a pertinent one in today’s rapidly evolving financial landscape. With the rise of online trading platforms and robo-advisors, many have speculated about the relevance of traditional stock brokers. However, despite these advancements, stock brokers continue to play a crucial role in the investment ecosystem.

The Evolution of Stock Brokers:

Stock brokers have evolved significantly over the years, adapting to technological advancements and changing investor preferences. While traditional brokerage firms still exist, they have embraced technology to offer online trading platforms and digital advisory services.

Personalized Investment Advice:

One of the key advantages of working with a stock broker is the personalized investment advice they offer. Unlike automated platforms, stock brokers take the time to understand their clients’ financial goals, risk tolerance, and investment preferences.

Access to Market Research and Analysis:

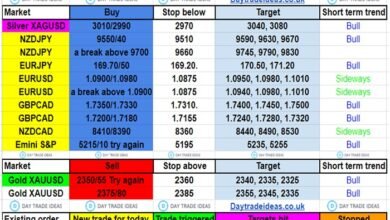

Stock brokers provide clients with access to a wealth of market research and analysis, helping them make informed investment decisions. From fundamental analysis to technical research, brokers offer valuable insights that may not be readily available to individual investors.

Execution of Complex Trades:

For investors with complex trading strategies or specialized investment needs, stock brokers offer expertise in executing intricate trades. Whether it’s options trading, futures contracts, or foreign exchange transactions, brokers have the knowledge and resources to navigate these markets effectively.

Risk Management Strategies:

In today’s volatile market environment, risk management is more important than ever. Stock brokers assist clients in developing risk management strategies tailored to their individual needs, helping mitigate potential losses and preserve capital.

Wealth Management Services:

Many stock brokers offer comprehensive wealth management services beyond simple stock trading. From retirement planning to estate planning, brokers provide holistic financial solutions to help clients achieve their long-term financial goals.

Regulatory Compliance and Oversight:

Stock brokers are subject to stringent regulatory compliance measures, ensuring that they adhere to ethical standards and protect investors’ interests. This regulatory oversight provides an additional layer of security for investors who choose to work with licensed brokers.

Human Touch in a Digital World:

In an increasingly automated world, the human touch offered by stock brokers remains invaluable. Beyond just executing trades, brokers serve as trusted advisors, offering guidance and support to navigate the complexities of the financial markets.

Building Long-Term Relationships:

Stock brokers focus on building long-term relationships with their clients, providing ongoing support and guidance throughout their investment journey. This personalized approach fosters trust and loyalty, enhancing the client-broker relationship.

Conclusion:

while the financial landscape continues to evolve, stock brokers remain an essential part of the investment ecosystem. Their personalized advice, access to market research, and expertise in complex trades distinguish them from automated platforms. For investors seeking a human touch and tailored financial guidance, stock brokers continue to offer valuable services.

FAQ:

1. Are stock brokers still relevant in the age of online trading platforms?

Yes, stock brokers remain relevant as they provide personalized investment advice, access to market research, and expertise in executing complex trades.

2. How do stock brokers differ from automated investment platforms?

Stock brokers offer personalized advice and tailored financial solutions, whereas automated platforms rely on algorithms to manage investments.

3. Are stock brokers regulated?

Yes, stock brokers are subject to regulatory oversight to ensure compliance with ethical standards and investor protection measures.

4. Do stock brokers offer wealth management services beyond stock trading?

Yes, many stock brokers offer comprehensive wealth management services, including retirement planning and estate planning.

5. How do I choose the right stock broker for my needs?

Consider factors such as reputation, experience, services offered, and fees when selecting a stock broker that aligns with your financial goals and preferences.